DATA PRODUKTER

SIKKER DATA DELING

Enable new products with Secure Data Sharing

Create new data products with Secure Data Sharing

- With traditional data sharing, customers need to manually reconstruct data as it is transmitted, a potentially agonizing task when data is frequently updated or changed.

- Get access to live and consistent data with Secure Data Sharing enables over a secure connection

Connect directly to DEAS’ Data Platform without transferring files

- Secure Data Sharing is a feature that allows you to share data without moving or copying any data

- Secure Data Sharing is the most streamlined way to share data; Other methods for sharing data (such as EDI, FTP and even e-mail) require data deconstruction, file transmission, copying, reconstruction, and duplicative storage. Even cloud file services require the copying and sending of files, an inherently manual, static and time-consuming process.

Faster and easier data access and analysis, without the need for data movement or replication

- Enhanced data security and governance, with granular control over who can access what data and how

- Increased data value and innovation, with the ability to leverage data from multiple sources

Who

|

Michael Dyhr Sørensen Senior Manager Mobile: +45 30 93 49 10 E-mail: mds@deas.dk |

|

Svend Russel Sodhi-Henriksen BI Specialist Mobile: +45 39 46 65 79 E-mail: srsh@deas.dk |

KUNDEANALYSER

Unlock the potential: Automatic reporting in actionable dashboards

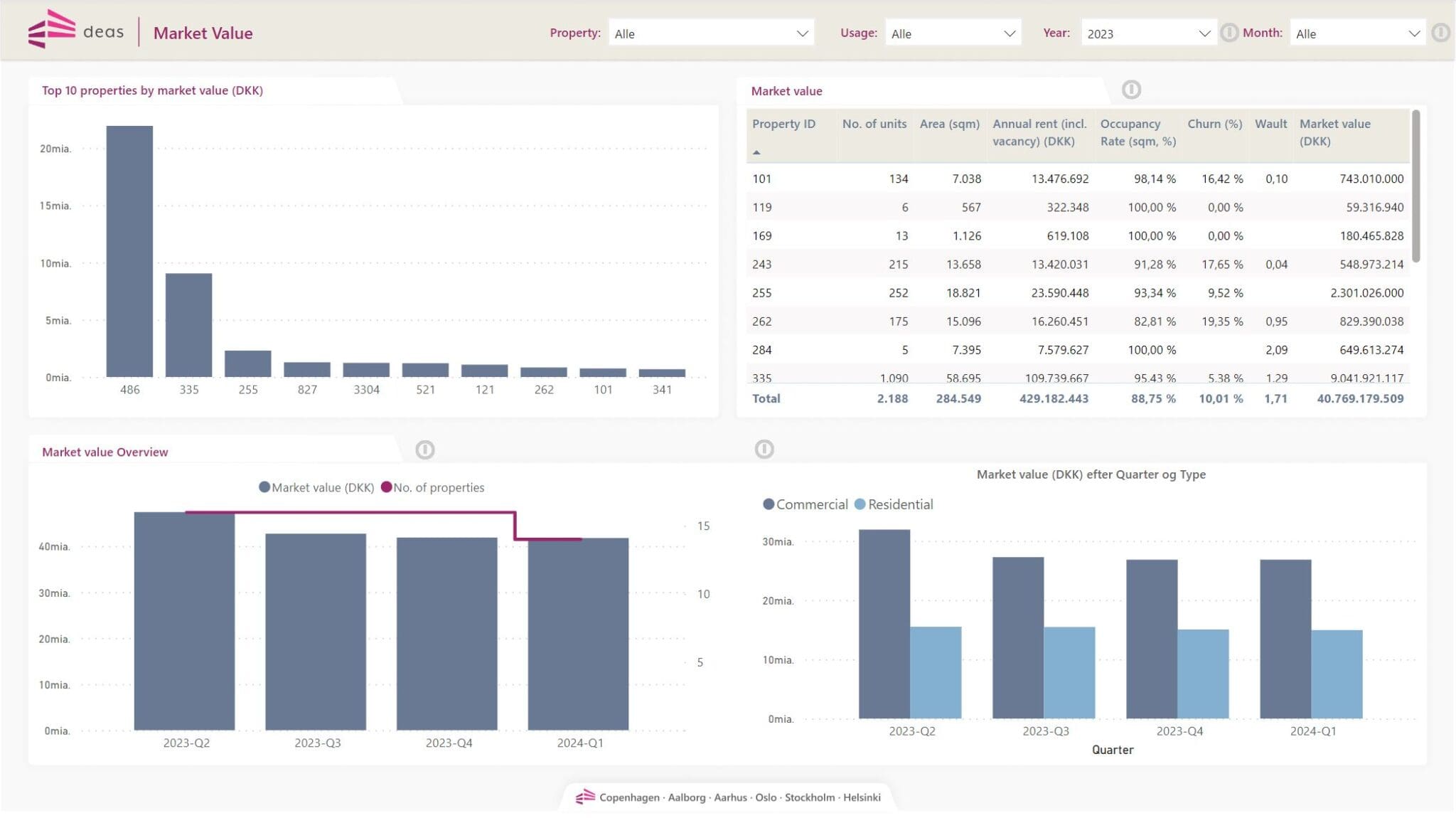

Why: Empowering your strategy and customer journey

- Equip your real estate portfolio with a comprehensive analysis tool for insightful customer understanding.

- Gain valuable insights into property overview, vacancy rates, lease structures, market values, financial health, and a detailed breakdown of residential and commercial tenants.

How: Customer Analysis for Strategic Advantage

- Advanced tools will provide insights into key aspects such as property overview, vacancy, lease terms, market value fluctuations, financial health indicators, and tenant profiles.

- Identify potential risks and opportunities within your property portfolio, allowing for targeted strategies to maximize returns and mitigate challenges.

What: Actionable insights to drive informed customer insights

- Deliver actionable insights derived from a comprehensive customer analysis, offering a holistic view of your real estate assets.

- Provide detailed financial impact analyses, giving you a clear understanding of the economic implications of different scenarios.

- Tailor a personalized advisory report with strategic recommendations, empowering you to make well-informed decisions for the future of your properties.

- Enable proactive measures to fortify your real estate holdings against market fluctuations and potential challenges, ensuring sustained value and resilience in the face of dynamic real estate landscapes.

Who

|

Svend Russel Sodhi-Henriksen BI Specialist Mobile: +45 39 46 65 79 E-mail: srsh@deas.dk |

|

Michael Dyhr Sørensen Senior Manager Mobile: +45 30 93 49 10 E-mail: mds@deas.dk |

PORTEFØLJEOVERSIGT

Unlock the Potential: Actionable Dashboards for Financial Performance and NOI Analysis

Why: Maximize Profitability and Efficiency

Equip your real estate portfolio with advanced tools to enhance financial health, focusing on Net Operating Income (NOI) and operational expenses (OPEX). These dashboards provide critical insights for informed decision-making, driving profitability and efficiency.

Gain insights into:

- Net Operating Income (NOI): Monitor and assess trends to gauge property profitability, offering detailed breakdowns and time series analyses.

- Operational Expenses (OPEX): Track and manage OPEX to optimize expenses and identify cost-saving opportunities.

- Performance Metrics: Focus on NOI growth and OPEX efficiency through detailed analyses.

How: Portfolio Analysis for Strategic Advantage

Utilize advanced tools to gain financial insights:

- NOI Analysis: Highlight income stability and growth factors.

- OPEX Analysis: Identify opportunities for cost reduction and efficiency improvements.

- Cost Group Analysis: Break down NOI and OPEX at the cost group level to identify trends and pinpoint areas for improvement.

What: Actionable Insights for Decision-Making

- Comprehensive Asset View: Offer thorough financial analyses for a complete performance picture.

- Impact Analyses: Clarify economic implications from various scenarios.

- Strategic Reports: Provide recommendations to maximize NOI and minimize OPEX

Integrate these actionable dashboards to unlock your real estate investments’ full potential, driving better performance and strategic growth with a focus on maximizing NOI and optimizing OPEX.

Who

|

Michael Dyhr Sørensen Senior Manager Mobile: +45 30 93 49 10 E-mail: mds@deas.dk |

|

Svend Russel Sodhi-Henriksen BI Specialist Mobile: +45 39 46 65 79 E-mail: srsh@deas.dk |

BEBOERUNDERSØGELSE

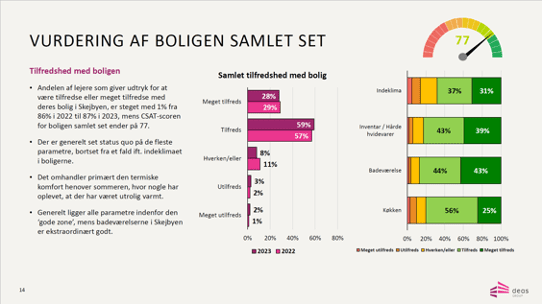

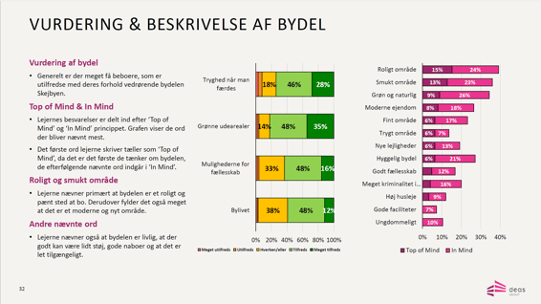

Unlock the insights: Use unique and actionable insights from tenant surveys

Why: Meet the tenant demand based on our unique survey insights

- Gain valuable insights into the demand and needs from tenants based on the insights from our surveys.

- Understand their preferences, expectations, and requirements to elevate the overall tenant experience.

- By integrating these strategies, you will also create a positive cycle of tenant satisfaction which enhances the overall asset value.

How: Tailored surveys for tenant satisfaction

- DEAS conducts in-depth surveys covering a wide range of topics, from amenities and services to lease structures and community preferences.

- Utilize targeted sampling techniques to ensure representation across diverse tenant demographics, guaranteeing a holistic understanding of preferences.

- Implement continuous feedback loops, enabling us to capture evolving tenant needs and preferences in near real-time.

What: Insights derived from tenant surveys

- Understand specific amenities and services tenants value most, enabling us to tailor offerings to meet these preferences.

- Identify preferred lease structures and terms, facilitating the creation of flexible and tenant-friendly agreements.

- Learn about the community and environmental features that matter to tenants, guiding property enhancements and community-focused initiatives.

Hvem

|

Anders Mousten Christensen Senior Analysis Consultant Mobil: +45 27 90 19 79 E-mail: amc@deas.dk |

|

Christoffer Mortensen Analyst Mobil: +45 27 90 17 18 E-mail: chmo@deas.dk |

EJENDOMSBENCHMARK

Unlock the potential: Understand, compare and optimize property value

Why: Optimize Property Performance

- Understand how your property portfolio compares to nearby counterparts.

- Identify areas for improvement in rent pricing, operating costs, maintenance costs, and vacancy rates.

- Make informed decisions to enhance property value and attractiveness.

How: Advanced Analytics Approach

- Utilize AI algorithms to compare properties based on proximity and similar characteristics.

- Analyze key performance indicators like rent price, operating cost, maintenance cost, and vacancy.

- Translate data into practical strategies for property enhancement.

What: Detailed Benchmarking Report

- Deliver a detailed report on how your property portfolio stands against its nearest competitors.

- Offer tailored advice for performance improvement.

- Provide a clear pathway to achieving optimal property performance and market competitiveness.

You can see one of the reports in action here.

Who

|

Marcela Galvis-Restrepo AI Project Manager Mobile: +45 39 46 68 57 E-mail: mgre@deas.dk |

|

Abdulahi Mohamed BI Specialist Mobile: +45 77 89 05 23 E-mail: abmo@deas.dk |

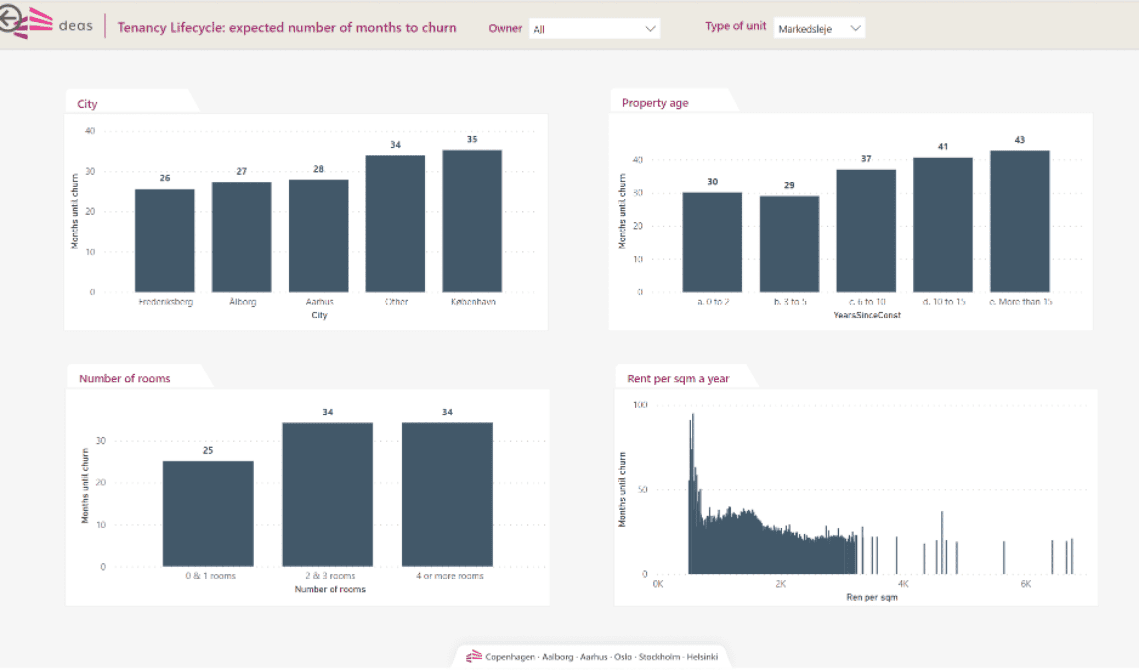

FLYTTESANDSYNLIGHEDER

Unlock the potential: Optimize the tenancy lifecycle through tenancy length predictions

Why: Enhancing Property Management and Planning

- Forecast tenancy lengths for effective property management.

- Use insights to anticipate vacancies and turnover, aiding in financial and operational planning.

- Advanced understanding of tenancy patterns boosts investor and tenant trust and satisfaction.

How: Leveraging Technology and Data

- Uses historical tenancy data, location amenities, and property characteristics.

- Incorporates AI for accurate tenancy length predictions.

- Easy-to-use design enables property managers to efficiently interpret and use data.

What: Strategic Decision Support

- Provides actionable insights for property enhancement and optimization.

- Assists in decision-making for future investments and improvements in properties.

Who

|

Marcela Galvis-Restrepo AI Project Manager Mobile: +45 39 46 68 57 E-mail: mgre@deas.dk |

|

Michael Dyhr Sørensen Senior Manager Mobile: +45 30 93 49 10 E-mail: mds@deas.dk |

KLIMAOVERVÅGNING

Unlock the potential: Identify, mitigate and upscale the value of the property

Why: Safeguarding and Strengthening Your Property

- Provide a quick screening tool to assess climate risk for all properties in a portfolio.

- Identify high-risk buildings for targeted sustainability efforts.

- Use risk assessments to negotiate lower insurance premiums for company-administered buildings.

How: Risk Identification and Mitigation

- Utilize tools and efficient structures to highlight climate risks (e.g., cloudbursts, groundwater changes, storm surges, flood directives).

- Mitigate identified risks to ensure safety and longevity of properties.

- Provide reassurances to tenants, investors, and stakeholders.

- Fortify buildings against climate challenges, maximizing investment value.

What: Delivering Actionable Insights and Analysis

- Provide clear, actionable insights based on identified risks and mitigations.

- Deliver detailed financial impact analysis.

- Include a customized advisory report with recommended actions.

- Empower informed decision-making for property futures amidst climate change.

Who

|

Michael Dyhr Sørensen Senior Manager Mobile: +45 30 93 49 10 E-mail: mds@deas.dk |

|

Marcela Galvis-Restrepo AI Project Manager Mobile: +45 39 46 68 57 E-mail: mgre@deas.dk |